OVERVIEW

One often hears of great bargains offered by banks in repossessed/foreclosed properties. Although the offers are tempting, since they are offered at a 30-40% discount from market rates, one has to be careful while buying such properties/flats as many, if not all, have glaring shortcomings in their legal status. Many lack the proper building permissions and others lack permissions which are specific to Navi Mumbai.

CIDCO ROLE

Navi Mumbai was formed by acquiring land in the 1970’s by CIDCO, which was designated as the planning authority for Navi Mumbai. Villagers were compensated as per the land acquisition act and given adequate compensation along with land which they could sell in the open market to builders or build on it themselves. The scheme for such construction was called Sade Barah Takka (12.5%) GES (Gaothan Expansion Scheme).

Since CIDCO is the planning authority, it framed rules under Navi Mumbai Disposal of Lands Act and Navi Mumbai DIsposal of Land Rules. These rules also incorporated conditions for sale of flats/Shops/Land which defaulted on mortgage/loans taken from banks.

DOCUMENTS REQUIRED

Once should make sure that the following documents are in place before purchasing the Flat/Shop/Land:-

- Building permissions from CIDCO/NMMC (CC, OC, Sanctioned Plans)

- Society Formation/Registration Documents

- CIDCO Conveyance Documents of the Society

- CIDCO approved List of Members of the Society (This list is approved by CIDCO on its letterhead before the Conveyance application of Society is Processed by CIDCO.

- CIDCO Final Order in Favor of the Society

- Mortgage NOC obtained by defaulting owner from CIDCO

- NOC from society allowing the bank to repossess and sell the flat

- District Magistrate Court (Collector) Order for foreclosing the loan and repossessing the flat/shop issued under SARFAESI ACT and Rules

- NOC from CIDCO for selling the flats via Auction (To be obtained by the Bank from CIDCO)

Once these documents are available, one can bid in the online auction of the bank.

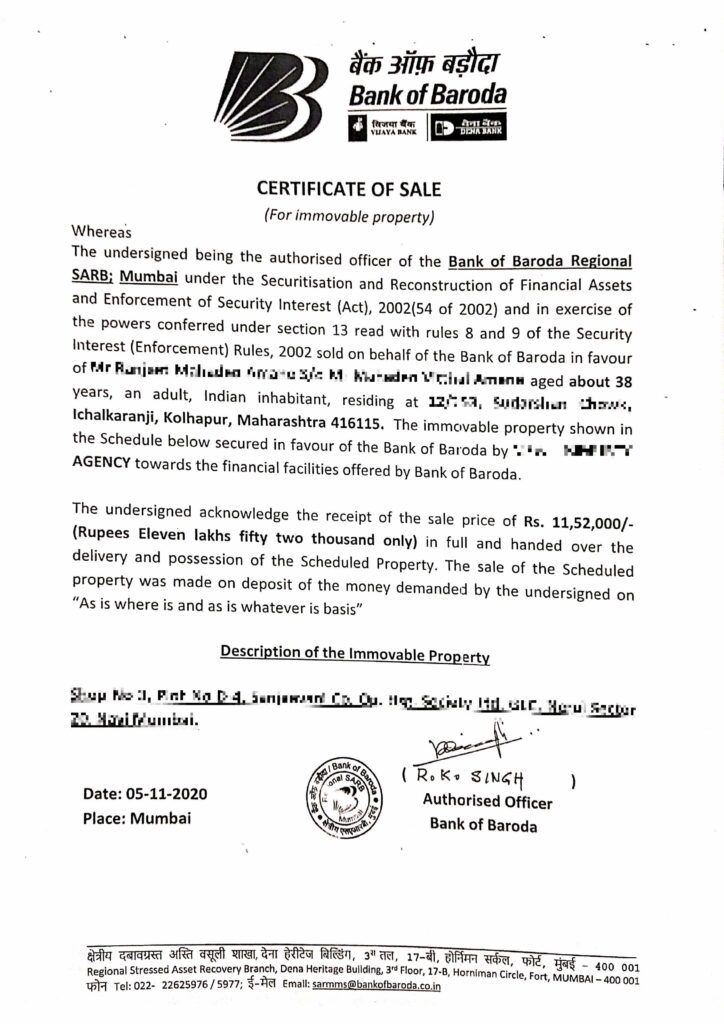

On winning the bid, the bank issues a certificate of sale (a letter on the letterhead of the bank stating that you have won the bid and paid the money)

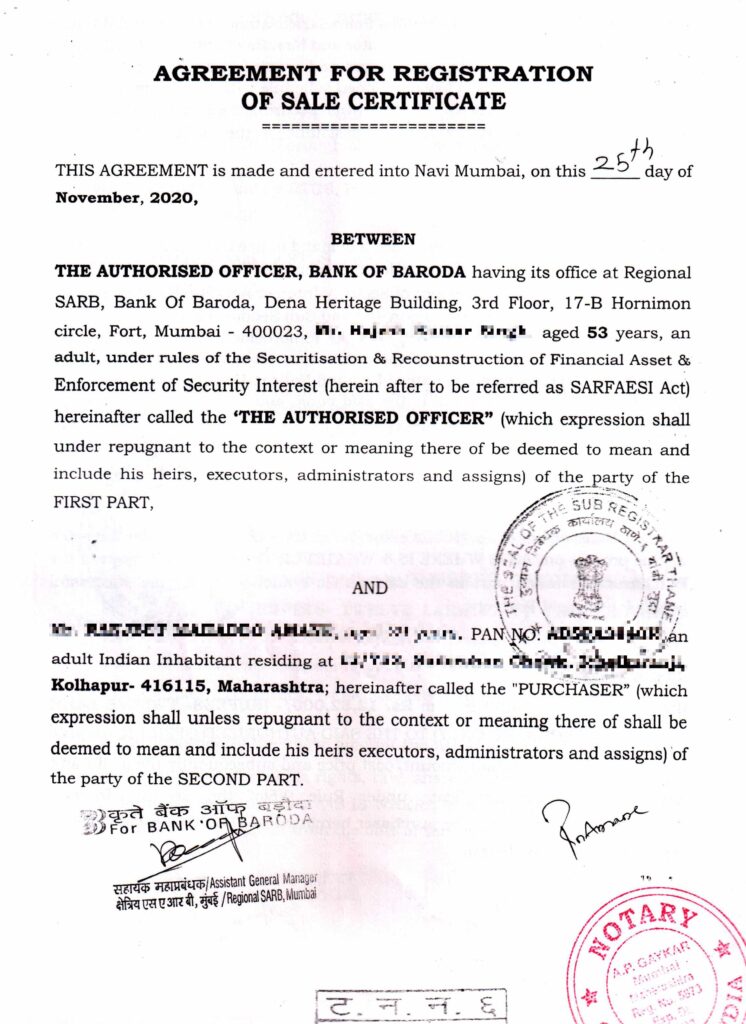

Once the certificate of sale is issued, it is then registered along with a sale agreement at the Registration office of the Revenue Department. Stamp Duty on the Auction Price or the Ready Reckoner Rate (whichever in higher) has to be paid. Registration charges also have to be paid.

After that the winning bidder has to approach CIDCO with a full set of documents and affidavits and NOCs and obtain the CIDCO NOC for the sale. If the payment is without a loan or in one shot, then CIDCO will issue a Final order directly, or else one will have to obtain a CIDCO NOC for availing a bank loan after part payment, and then apply for a Final order after making the balance payment via Loan Disbursal. Final order will have to be obtained from CIDCO after execution and registration of the Sale Deed.

Copies of all documents are given below for reference.

Sky Properties, Nerul, Navi Mumbai

Address A-1, 7,2, Sneh Co Op Society, Plot no 16, Sector 19a, Nerul, Navi Mumbai 400706

Call Us 9987452642

mayur@navimumbaiestate.in